Introduction

The report discusses the economic impact of coronavirus in the UK. The report is separated into two parts where part 1 will discuss the demand and supply for deciding about the negative and positive shifts of the changes in customers’ demand and wants regarding the retail product and services. The second part of the report will discuss the findings and explanation of the economic policies and governmental processes in the UK about the conditions of economic conditions of the retail spending by the consumers of the sector are discussed for the United Kingdom.

Factors affecting UK consumer retail

The consumer retail of the UK is being affected by various factors which are related to the retail spending of the consumers are discussed below:

UK regional factors

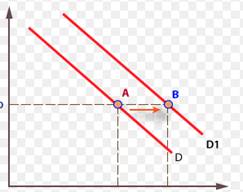

The regional factors are hardly impacted by the retail spending rates of the consumers due to the effects of the coronavirus pandemic in the UK. The contaminated areas by the virus are being restricted by the government administrators for protecting the spread of the virus as per result the areas would be sealed down with complete lockdown in the UK. The lockdown situations and sealing of contaminated areas have affected the demands of retail products as the demand for the retail products in the non-contaminated areas has increased as people are free to move there (Andersen, et. al., 2020). The demand is falling in the areas with restrictions. The supply will be boosted in the areas without any restrictions and be provided with the demand for the products. The rise in demand will be seen in the online retail products of the areas where the restrictions are strong and people are ordering their goods and products from their homes but the areas with low restrictions do not have demand in the online market areas.

The above diagram shows the shift in the areas as the observed difference in demand in restricted areas and non-restricted areas. The demand for the goods and products will be increased in the non-contaminated areas as the demand for the retail goods will be consistent with the shift in demand of the curve from point D to D1.

The population of the UK

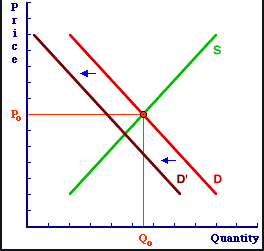

The population of the UK is an important factor for the economy as the consumers are the ones to demand retail goods in the UK. The areas with dense population in the UK will receive higher demands of retail goods and products whereas the less densely populated areas in the UK will have a lower amount of demand for the retail products (Baker, et. al., 2020). The low populated areas will have less demand and ultimately lower levels of supply but in the densely populated areas, the demand and supply of the retail goods and products will increase as per the requirements of the consumers. The pandemic period records the higher demand from the highly populated areas in the UK as the retail goods are supplied in those areas.

The graph shows the areas of less population with less amount of retail product supply and this resulted in a decrease in demand for the retail products spend by the consumers of this area. The demand curve has shifted from point D to D’ as the left shift is seen due to the decline in the demand for retail goods.

Employment shifts and income effects

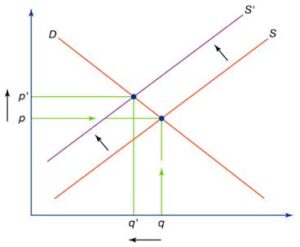

The economy of the UK has also impacted by the employment and income effects as the pandemic has resulted in snatching many jobs from workers and forced major companies to start working from home with lower salaries as the employees are being given half incomes. The income and employment effects have impacted the retail spending of consumers as the economic conditions of individuals are being affected by a coronavirus (Barnes, 2020). This has led towards a decline in retail product spending which also impacted the decline of supply in retail goods and services.

The graph shows the income levels of the people in the UK where the coronavirus pandemic has dropped down their income and made it hard for people to buy retail goods and products. Due to the cut-off in income levels, the demand for retail goods has decreased which is shown in the graph, and also declined the supply range of retail products where the shift towards left from S to S’ has been seen for declination of supply.

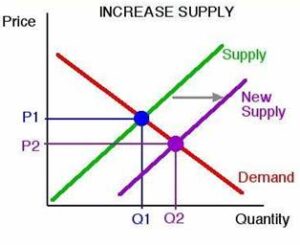

Purchasing limits, subsidies, and other governmental interventions

The government of the UK has gone through various interventions, providing subsidies and the establishment of purchasing limits due to the problem of fewer stocks of goods in the time of coronavirus pandemic (Bhatti, et. al., 2020). These interventions by the government have taken for increasing the demand and supply of the retail products and goods for the consumers to make them able to purchase the goods and retail products with stock availability. This will lead to the supply and demand rise in the retail market of the UK.

The graph showed the rise in the supply of retail goods and services due to the increase in income rise which is the impact of the actions taken by the government for increasing demand and supply of the products and goods of the retail sector. The purchase limits, subsidies, and government interventions have helped in the increased supply and demand for retail products and goods. The graph shows the effect of a shift in the situation from the supply to the new supply curve.

Substitute or complementary goods

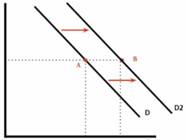

The pandemic has impacted the various goods and products in the UK. The pandemic situations were dealt with by the government by putting strict restrictions such as lockdowns in various parts of the UK (Chetty, et. al., 2020). The people of the UK were restricted to come out of the house and every service in the UK was stopped to control the spread of the pandemic. As per the complementary goods or substitute the demand for petrol and diesel were decreased as no vehicles were used for a long period in the UK due to the lockdown. There were many products and goods which were in lower demands as per the pandemic effects in the country and many products were purchased in bulk orders for storing which resulted in stock unavailability (Coibion, et. al., 2020). For instance, coffee was out of stock in the UK which is a popular beverage and tea become in demand suddenly as coffee was unavailable. Earlier the demand for tea was low and supply was also low but the pandemic era increased the demand and supply on boosting levels in the UK.

The above graph shows the levels of demand and supply for coffee and tea as pandemic has made tea the substitute for coffee products. The graphs clearly show that the demand for tea has increased as the curve shifted towards the right from D to D2 for tea demand.

The above factors were related to the factors as the demand and supply were affected by the pandemic situations which impacted the retail sectors for various advantages and disadvantages to lead the changes for people spending percents.

Economic and government policies for aid in the UK

The government of the UK is focusing on various kinds of economic and government policies for aiding the economic recovery for the country and increasing the customers’ retail spending rates for increasing the demand and supply for the retail products and goods which are being dropped down during the period of a pandemic. Some of the policies of economic and governmental aid process are as follows-

Programs related to poverty

The poverty rates in the UK have been seriously impacted by the pandemic situations. The excess poverty is becoming the new situation for the UK pandemic has hilted very hardly to poor people in the UK (Dunn, et. al., 2020). The government has been raising donations and allowances for the poor people in the UK to benefit the poverty affected citizens to deal with this hard situation crisis. The furlough program has been initiated by the government to deal with the situation in which the businesses are made to promise to increase the wage percents for the employees to make them favoured in difficult situations. The program will help in encouraging employers to help the employees by supporting them with their wages increment. This will help poor people to survive and boost up economic conditions. The poverty will be helped from the local vendors to the small businesses which play an important role in the business positions and economic conditions of the whole country (Fernandes, 2020). Poverty has been increased at high rates due to various reasons as the pandemic has resulted in losing jobs from employees and shutting down established business firms which impacted millions of people around the globe. The government will launch various programs in which the poor will be provided with support on monetary terms to start a new life which will lead to prosperity and boost the economy of the UK.

Retail subsidies

The retailers were the majority of the people who were affected by the pandemic crisis all over the world. The government has introduced a scheme for the coronavirus interruptions of the businesses temporarily to be provided with easy access towards the lending and overdrafts to help the SME’s in the UK as they were highly affected by the decrease in demand and supply of the retail goods and products (Grashuis, et. al., 2020). For providing financial stability and a boost after the impacts of the covid-19 crisis, these small businesses will be provided with 80% of the loan by the government institutes to boost up the economic conditions of the UK. The packages for the business rates will be introduced to relieve the retail businesses in England. The interest rates are also reduced for providing the businesses the time for coming back on track for the market needs and wants as these businesses are very important for the economic conditions of the whole country. The local authorities will be provided with the funds for helping the business grants which will be about 10,000 to 700,000 Euros (Hwang, et. al., 2020). The retail business has been impacted adversely by the pandemic in which the demand and supply chains were nearly broken as the people were not present in the market for economic cycle due to the restriction in the country facing lockdown situations. These are required to be provided with subsidies to re-establish the retail cycle to support the economy of the UK.

Stimulus packages

By the motive of curing the economy of the impact of COVID 19, Rishi sunak’s plans associated with the job description set the government practices or strategies. Also, the policies were targeted to the stimulation of requirement in the industry that has been majorly affected due to the social distancing;policies can assist in developing improvement in the United Kingdom infrastructure and supporting the unemployed individuals to identifying the employment for better growth of the country (Loxton, et. al., 2020).

Government policies concerning the job plans havegot the expenses of £ 30 billion. it is analyzed chancellor of the UK has been introduced the evaluation that was targeted the hotel and tourism industry. VAT tax refersto that tax which is paid for food items, accommodation, and tourist attractions can be eliminated by the 20% amount to 5% (Nicola, et. al., 2020). Along with this, it helps in reduces the rates and prices that can motivate the people to enhance their expenditure on pubs, hotels, restaurants and so more. Government officers also introduced eat out schemes that included 50% discounts in the restaurants for having a meal on Monday, Tuesday, and Wednesday in August. It also helps in developing and improving the restaurants and cafes demand and by this, they will be engaged within reduced and lower capacities.

Industry-specific measures

In this matter, UK higher government authority has taken various steps for reducing COVID 19 and also providing supporting hands to different sectors during the pandemic. Besides this, the government is planning to contribute and distribute the required wages to the employees in which lower demand can specifically indicate that they have to perform their work for some hour as compared to the normal hours. On the other hand, if the workers are capable to do work for upto 33% of their whole normal working hours then there is no need to perform long time work to the employees (Prentice, et. al., 2020). For increasing the growth of the sectors and country GDP, UK requires to open some sectors through which theycan gain some amount and balance the growth level. It has been observed that the UK government will also announce certain of the business rates that can be associated with the holiday for the hotel industry, retail sectors, and also leisure businesses. UK Government developing new guidelines for differentindustriesso they can re-open business operations and focus on maintaining social distancing with their staff members. The England business units such as hospitality, retail, and leisure businesses can be eligible for opening and their size does not matter. for attaining the benefits, various situations can be described as under:

• Hotels, self-catering accommodations, guest houses.

• It involves bars, restaurants, cafes, shops, live music and cinema halls, and malls.

• It can be done for the goal of leisure and assembly.

It has been analyzed that the UK government also plans to provide a refund for sick pay to such employees who cannot able to perform work at the time of this pandemic for around 2 weeks (Vafainia, 2020). It will be applied for those employers who have less than 250 staff members in their workplace. Also, companies do not cut their pays during the COVID 19. The above-described information isreferredto as policies and measures that were used by the government for maintaining and managing their economic rate from the major impact of coronavirus. Along with this, this will help retail sectors by providing some packages and prices that demand can be increased (Sheridan, et. al., 2020).

Conclusion

From the above-described report, it is concluded that coronavirus impacted the whole country and its growth rate which needs to be improved. It discusses the effect of COVID 19 on the UK economy in the different sectors and especially for the retail industry. In this, two tasks have been described in which demand and supply analysis were developed and it showed that retail business had face a positive impact due to the pandemic. Besides this,some other businesses face having a negative impact because of the pandemic. In addition to this, demand and supply factors have been examined with the assistance of diagrams. The report also discussed the reflection about the government’s economic regulations and policies which help in controlling the effects of the pandemic through which they would able to recover the UK economy.

References

Andersen, A.L., Hansen, E.T., Johannesen, N. and Sheridan, A., 2020. Pandemic, shutdown and consumer spending: Lessons from Scandinavian policy responses to COVID-19. arXiv preprint arXiv:2005.04630.https://arxiv.org/pdf/2005.04630.pdf

Baker, S.R., Farrokhnia, R.A., Meyer, S., Pagel, M. and Yannelis, C., 2020. How does household spending respond to an epidemic? consumption during the 2020 covid-19 pandemic (No. w26949). National Bureau of Economic Research.https://www.nber.org/system/files/working_papers/w26949/w26949.pdf

Barnes, S.J., 2020. Information management research and practice in the post-COVID-19 world. International Journal of Information Management, p.102175.

Bhatti, A., Akram, H., Basit, H.M., Khan, A.U., Raza, S.M. and Naqvi, M.B., 2020. E-commerce trends during COVID-19 Pandemic. International Journal of Future Generation Communication and Networking, 13(2), pp.1449-1452.https://lovacky.eu/ws/media-library/8291b8bb61d0458d9bec753432dc4842/qualitativepaper.pdf

Chetty, R., Friedman, J.N., Hendren, N. and Stepner, M., 2020. How did covid-19 and stabilization policies affect spending and employment? a new real-time economic tracker based on private sector data (No. w27431). National Bureau of Economic Research.https://www.nber.org/system/files/working_papers/w27431/w27431.pdf

Coibion, O., Gorodnichenko, Y. and Weber, M., 2020. The cost of the covid-19 crisis: Lockdowns, macroeconomic expectations, and consumer spending (No. w27141). National Bureau of Economic Research.https://www.nber.org/system/files/working_papers/w27141/w27141.pdf

Dunn, A., Hood, K. and Driessen, A., 2020. Measuring the effects of the COVID-19 pandemic on consumer spending using card transaction data. US Bureau of Economic Analysis Working Paper WP2020-5.https://www.bea.gov/system/files/papers/BEA-WP2020-5_0.pdf

Fernandes, N., 2020. Economic effects of coronavirus outbreak (COVID-19) on the world economy. Available at SSRN 3557504.file:///C:/Users/91998/Downloads/SSRN-id3557504.pdf

Grashuis, J., Skevas, T. and Segovia, M.S., 2020. Grocery shopping preferences during the COVID-19 pandemic. Sustainability, 12(13), p.5369.file:///C:/Users/91998/Downloads/sustainability-12-05369-v2.pdf

Hwang, E.H., Nageswaran, L. and Cho, S.H., 2020. Impact of COVID-19 on Omnichannel Retail: Drivers of Online Sales during Pandemic. Available at SSRN 3657827.

Loxton, M., Truskett, R., Scarf, B., Sindone, L., Baldry, G. and Zhao, Y., 2020. Consumer behaviour during crises: Preliminary research on how coronavirus has manifested consumer panic buying, herd mentality, changing discretionary spending and the role of the media in influencing behaviour. Journal of Risk and Financial Management, 13(8), p.166.https://www.mdpi.com/1911-8074/13/8/166/htm

Nicola, M., Alsafi, Z., Sohrabi, C., Kerwan, A., Al-Jabir, A., Iosifidis, C., Agha, M. and Agha, R., 2020. The socio-economic implications of the coronavirus pandemic (COVID-19): A review. International journal of surgery (London, England), 78, p.185.

Prentice, C., Chen, J. and Stantic, B., 2020. Timed intervention in COVID-19 and panic buying. Journal of Retailing and Consumer Services, 57, p.102203.

Sheridan, A., Andersen, A.L., Hansen, E.T. and Johannesen, N., 2020. Social distancing laws cause only small losses of economic activity during the COVID-19 pandemic in Scandinavia. Proceedings of the National Academy of Sciences, 117(34), pp.20468-20473.

Vafainia, S., 2020. Marketing in post COVID-19 era: A guide for marketing managers. Managing a Post-Covid19 Era, p.31.